14th May 2020

Lloyd’s CEO John Neal has said repricing “has to happen” following the substantial industry losses from Covid-19, and pledged flexibility in permitting additional growth to the market as rates rise.

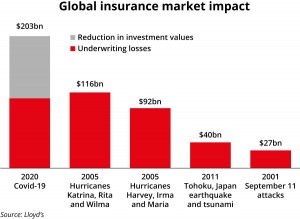

This morning, Lloyd’s released an industry underwriting loss estimate of $107bn for Covid-19. When including the expected hit to investments, this total industry impact rises to $203bn, Lloyd’s said.

The Lloyd’s market is expected to take $3bn-$4.3bn of the Covid-19 underwriting losses.

Speaking to Insurance Insider, Neal said: “You can’t put a potential $200bn loss into the non-life insurance industry and not expect the market to reprice.”

He added: “I hope we will learn from experiences of the past, whether that was 9/11 or another event, and realise that this has to be a significant pricing event.”

The Lloyd’s CEO said the Corporation would be as accommodating as it reasonably can be in permitting syndicates to grow in a hardening market.

Lloyd’s performance management directorate has been tough on growth in the past two years as it has sought to rectify market performance, a process which is still ongoing. The market has previously complained that Lloyd’s would not allow it to grow ahead of risk-adjusted rate.

“If there is growth that’s price-driven we will be very quick to support that,” Neal told this publication.

He said that Lloyd’s would do as much as it could to approve business plans quickly and simply, and “there would be forgiveness if the right opportunities are there within your plan to grow”.

The light-touch cohort of outperformers will gain automatic plan approval and therefore freedom to grow.

Neal said those which are not light touch, Lloyd’s had revamped the standard approach to business planning around some KPIs. Provided the plans are credible, and there is clear demonstration of how managing agents got to their forecasted loss picks, “we can fast track those approvals”, Neal said.

“I think the vast majority of syndicates will fall into those two buckets. If plans are sensibly constructed they will be approved,” Neal said. “But there is a third bucket, the high-touch syndicates, and if they have been a problem it will be a difficult set of discussions.”

The high-touch cohort is made up of both underperforming syndicates and those which are deemed material to the market – either due to their size or cat exposure. Lloyd’s 2020 planning documentation shows the high-touch cohort has around 20 syndicates and accounts for around 45 percent of market premium.

Lloyd’s will also be accommodating to new capital wishing to support Lloyd’s businesses as the market enters a period of opportunity, Neal said.

He pointed to the two new Lloyd’s entrants recently approved – Carbon and Ki – and said the syndicate in a box framework was generating steady levels of interest.

“Our ILS work continues, so there is no reason why that alternative capital shouldn’t come in,” he said. “There is still interest from those not yet participating in the market, who are thinking about when entry to Lloyds is the right time.

“As difficult as this pandemic is for our customers, and how devastating the broad impact has been, there is an opportunity for insurers.”

Lloyd’s is extremely well capitalised and will be able to shoulder the cost of Covid-19, Neal said, noting that the twice-yearly recapitalisation opportunities at Lloyd’s meant the market should also be able to bolster capital before the peak US wind season.

Neal also warned that the Covid-19 impact would drag out over a number of years, with the first year creating a catastrophe-type loss, then the effects of recession being felt on premium income in the following years.

“We have also got to keep a really strong eye on inflation probably for two years out,” Neal said. “I think our businesses at Lloyd’s have learned that we have got to adjust price to keep pace with the recessionary and inflationary impact that will echo through 2021 and 2022.”